What’s Quietly Changing in Engineering Decision-Making in 2026

Engineering decision-making rarely changes overnight. Instead, it evolves gradually, shaped by delivery pressure, accumulated experience, and real-world project outcomes rather than by trend reports or industry announcements.

Yet across UK engineering and industrial projects, something is clearly shifting. Conversations that once centred on speed, price and capacity are quietly being replaced by different concerns. Not because buyers are explicitly changing strategy, but because the environment around them has changed.

What follows is not a prediction, nor a trends piece. It is an observation of how engineering decision-making is being recalibrated in practice.

From Speed to Certainty in Engineering Decisions

For years, fast lead times dominated early conversations. Being first to start often felt like the safest option but that logic is weakening.

Increasingly, engineering decision-making is shaped by what happens after work begins:

- How changes are handled once designs evolve

- Whether finishing and compliance requirements are fully understood upfront

- How predictable delivery remains when pressure builds

Speed still matters, but certainty matters more. Buyers are asking fewer questions about how quickly something can start, and more about how confidently it can continue.

This shift reflects a growing awareness that engineering capability and not just capacity, determines whether projects absorb change or unravel under it. That distinction is explored in more depth in this explorative article.

What’s No Longer Driving Engineering Decision-Making

Several familiar priorities are quietly losing influence.

- Headline lead times are no longer taken at face value.

- Lowest-cost quotes are being interrogated more closely.

- Promises without evidence carry less weight than they once did.

This doesn’t mean cost and timing have stopped mattering; it means they are no longer trusted as standalone indicators of delivery success.

In practice, many late-stage issues trace back to early decisions made under pressure, where complexity was underestimated or fragmented across suppliers. The strategic risk of optimising too aggressively for speed is becoming harder to ignore, particularly in regulated or high-value environments.

As a result, engineering decision-making is becoming more cautious, but also more deliberate.

Fewer Suppliers, Deeper Trust in Engineering Decisions

Another subtle shift is consolidation.

Managing five or six disconnected suppliers once seemed efficient. Today, it often feels like a liability. Each handover introduces risk, delay, and ambiguity, especially when specifications change or responsibilities overlap.

Engineering decision-making is increasingly favouring fewer, deeper relationships with partners who understand the full lifecycle of a project, rather than isolated tasks within it. The goal is not convenience, but coherence.

This change reflects a broader desire to reduce escalation points and create clearer ownership, particularly when things don’t go to plan.

The Return of “Boring but Important” Work

Not all engineering work is meant to be exciting.

Some of the most valuable projects are those that never make headlines: infrastructure upgrades, defence support, energy systems, rail, maintenance, and compliance-driven manufacturing. They are long-term, repeatable, and unforgiving of error.

Engineering decision-making around this work prioritises reliability over novelty. These projects succeed precisely because nothing dramatic happens. Tight tolerances are met, documentation holds up and delivery is predictable.

This type of work is far from declining and in fact, it’s increasing, driven by ageing infrastructure, energy transition requirements and sustained defence investment.

Why Engineering Decision-Making Is Shifting Now

This rebalancing is not accidental.

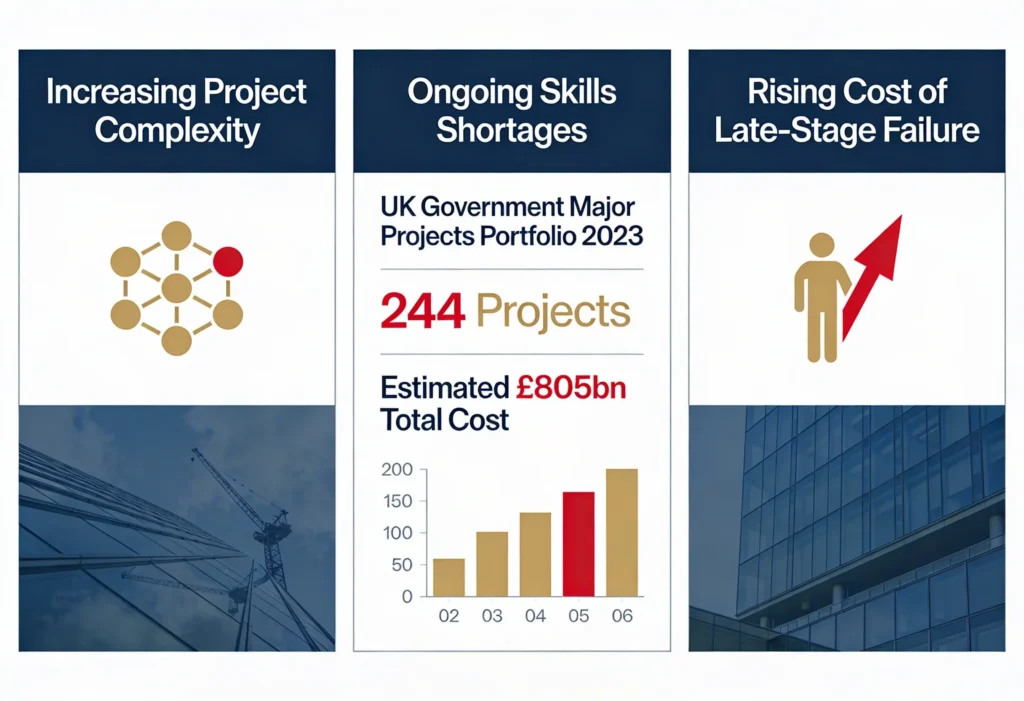

Projects are larger, more interconnected, and more exposed to downstream risk than they were a decade ago. Skills shortages persist. Regulatory expectations continue to rise. Late-stage problems are more expensive, financially and reputationally.

According to the UK National Audit Office, the Government Major Projects Portfolio contained 244 projects with a combined whole-life cost of approximately £805 billion as of 2023, highlighting the scale and complexity now typical of major programmes.

In this context, engineering decision-making is becoming more risk-aware, more evidence-driven, and less tolerant of uncertainty disguised as optimism. Hidden constraints and bottlenecks, often invisible early on, are being treated more seriously as a result.

Where This Leaves Engineering Decision-Making for Serious Buyers

For buyers operating in complex, regulated, or long-cycle environments, engineering decision-making is converging on a simple question:

Can this organisation absorb complexity without destabilising delivery?

The answer increasingly lies in structure, experience, and integration; not in isolated services or surface-level metrics. Businesses designed around engineering delivery rather than task execution are better positioned to meet this expectation.

PRV Engineering operates within this reality, focusing on end-to-end responsibility, delivery confidence, and long-term partnerships rather than short-term optimisation. Further context on how PRV is structured, including certifications and supporting documentation, can be found on here.

Engineering decision-making will continue to evolve, but the direction is clear.

Certainty is replacing speed. Capability is replacing promises. And quiet competence is once again becoming a differentiator.

Recent Comments